The country’s poorest province is also afflicted by income inequality

SAKINA

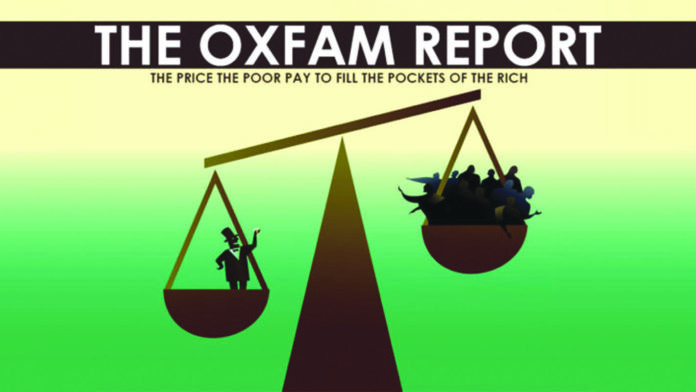

According to the Oxfam 2023 report, “Survival of the Richest”, inequality is increasing in the world. The poor are getting poorer, and the rich richer. According to the report, on account of such an increase, millions are facing hunger. The World Bank states that by 2030 it will not be able to achieve the goal of reducing extreme poverty across the world. According to Oxfam, the wealth of rich people is increasing by 6 times and they own 2/3rd of the world’s new wealth. Almost similar or even worse is the case with the area-wise largest province of Pakistan, Balochistan. It is estimated that more than 60 percent of its population, some 7.4 million people, live below the poverty line. Remember, this is the recorded estimate. Balochistan is struggling with corruption, poverty, unemployment, illiteracy, food insecurity, inflation, and political turmoil.

Fluctuating tax policies, corruption, and inequality have led to poverty in the province, and its impacts on poor people, but there is a way forward to overcome the effects of these crises. Balochistan is believed to have vast natural resources of gold, copper, natural gas, chromite, and valuable stones. But the resources have not had a trickle-down effect. There is a clear financial gap between the elite and the poor. The elite of this province live lavish lives whereas the poor in the province are getting poorer by the day. Similarly, inequality is increasing because the poor and rich almost pay equal taxes on goods and services. In Pakistan, the percentage of direct taxes is 37.2 percent (taxation on income sources, corporation tax, property tax and capital gains), and the percentage of indirect taxes is 62.8 percent (taxation on consumption like sales tax, services tax, and customs tax) which has increased in the past years.

Those who earn 100,000 per month have to pay a 2.5% tax on their income. However, those who earn less or do not even earn money, have to pay indirect taxes via sales tax on the basic commodities for livelihood. This is increasing the inequality gap. Balochistan is the least developed region not just in Pakistan but in South Asia. It is among the lowest ranked for health, education, and other social indicators, for various geographical and historical reasons. The literacy rate in the province is less than 43 percent, and the unemployment rate is fur percent. Similarly, corruption has broken the backbone of the province’s economy. Inflation has increased by 42.9 percent in the country. Out of its 35 districts, nine districts of the province face severe food insecurity. Not only the above factors, but the lack of leadership and continuous political instability, are also among the factors that contribute to the regressive situation of Balochistan. Recent floods have further worsened the situation for the lower class in the province.

The tales of corruption did not stop even in the recent floods. According to Information Minister Mariyam Aurangzeb, Pakistan received approximately $8 billion of aid from foreign donors to assist the flood-affected areas, but only $35 million was utilized for the flood affected. Even the donation money and relief packages fell prey to corruption. Instead of giving the tents and other basic commodities to the flood affected, the items were sold in the market. The people were left on their own with no help from government officials or NGOs. The poor people of the region affected by floods are becoming poorer because of high inflation via indirect taxes like the General Sales Tax (GST) on goods and services by the government.

The province has enough natural resources. But this province’s people have never benefited from their natural assets. The elite class of this province, due to their financial stability and power status, have access to the benefits of these resources more frequently, leaving the poor class behind. Many MPAs are multi-millionaires in the most backward province. Recently the brother of a senator was caught in the corruption case of Reko Diq. Moreover, several big smugglers have benefited from illegal border trade. They should be registered and taxed according to their wealth. Besides, the state’s taxation policies are not effective and properly implemented. The inconsistency in economic policies and flawed taxation policies like narrow tax base which means inefficient and non-neutral taxation, tax evasion, political involvement, and trust deficit tax collecting institutions suffer from, lead to high inflation and increase inequality and poverty. According to the report, the policies of countries are made in such a way that fulfills the greed of the elite class because they influence the state’s decisions.

Many landlords live in Pakistan but taxation on land and property is very low, only percent of the tax they pay is from the profit they generate from the land. The land tax upon such landlords should also be increased. To overcome such a crisis, the countries, specifically Pakistan, should tax the rich to decrease the inequality gap; by taxing the rich and subsidizing and poor can uplift the poor class as already suggested by the IMF officials to Pakistan. Taxing the wealthy is among the most effective weapons to tackle inequality and several crises. The solution to the current economic upheaval is to tax businesses and the wealthy more heavily. By immediately decreasing the quantity and capital of the super-wealthy, taxes promote extra-equitable societies and can help stop the rise of strong, unchecked, and semi-aristocratic powers. Additionally, it lessens harmful societal inequality. It has the potential to control inflation and high prices and prevent welfare cuts from being implemented. In October 2022, Great Britain taxed the rich, bringing a turning point to its economic crisis.

In addition, accountability departments should keep a check on politicians, bureaucrats, businesses and landlords to avoid tax evasion on their part. Also, the resources in Balochistan should be utilized for 75 percent of the people who live below the poverty line and to bring them above the poverty line, not only for the few elites.